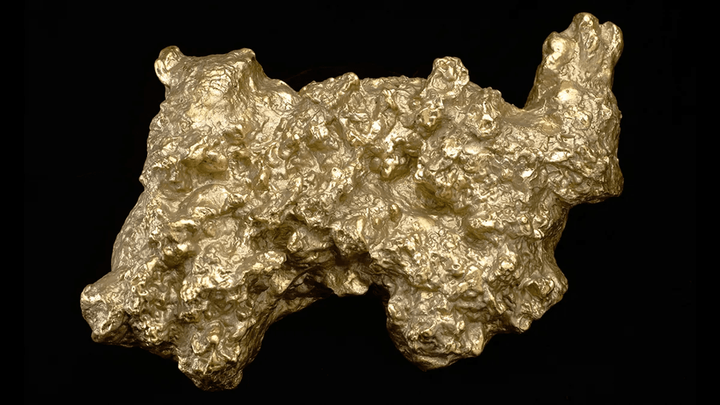

As the climate emergency intensifies, demand is surging for minerals that are critical for renewable energy technologies like solar panels, wind turbines and electric vehicles (EVs).

The United Nations (UN) Trade and Development (UNCTAD) projections based on data from the International Energy Agency indicate that by 2050, for example, lithium demand could rise by over 1 500%, with similar increases for nickel, cobalt and copper.

The booming demand poses significant opportunities and challenges for developing countries rich in critical energy transition minerals, especially those grappling with commodity dependence – when 60% or more of a country’s merchandise export revenue comes from raw materials.

Such dependence hinders economic development and perpetuates inequalities and vulnerabilities across sub-Saharan Africa, South America, the Pacific and the Middle East.

It currently affects 95 developing countries, almost half of the UN’s membership. A total of 29 out of the 32 nations classified as having low human development in 2021 were commodity dependent.

“Commodities and commodity dependence are issues at the heart of the past and especially the future of trade and development,” says Rebeca Grynspan, UN trade and development secretary-general.

Global investments in critical energy transition minerals are not keeping pace with escalating demand. Current production levels are inadequate to meet the needs required to limit global warming to 1,5°C, in line with the Paris Agreement.

UNCTAD has identified 110 new mining projects worldwide, valued at $39-billion, with $22-billion invested in 60 projects in developing countries.

However, to achieve the 2030 net-zero emission targets, the industry may need around 80 new copper mines, 70 new lithium and nickel mines each, and 30 new cobalt mines.

The investment needed between 2022 and 2030 ranges from $360-billion to $450-billion, potentially leaving a gap of $180-billion to $270-billion. The most significant shortfalls are in copper and nickel, accounting for 36% and 16% of the total gap, respectively.

The new critical mineral mining projects needed offer opportunities for many developing countries, especially in Africa. The continent boasts over a fifth of the world’s reserves for a dozen metals essential to the energy transition, including 19% of those required for electric vehicles.

But to fully capitalise on their mineral wealth, developing countries must go beyond merely supplying raw minerals and advance up the value chains.

UNCTAD analysis of EV supply chains, reveals that no country from Africa or Latin America is currently a major player in manufacturing or trading cathodes or battery materials.

However, the Democratic Republic of the Congo’s experience shows that developing countries can make progress in adding some value to their minerals.

By refining and processing cobalt locally, the country boosted the mineral’s unit price from $5.8 per kilogram at extraction to $16.2 per kilogram after processing. With this initial move up the value chain, the African nation’s exports of processed cobalt reached $6-billion in 2022, compared to just $167-million in exports of unprocessed cobalt.

To strengthen their industrial sectors, diversify their economies, and redefine their roles in the global economy, developing countries rich in critical energy transition minerals must avoid past pitfalls of commodity dependence.

Otherwise, the current surge in demand for these minerals could further entrench commodity dependencies, worsening economic vulnerabilities while the benefits remain out of reach for local communities and businesses.

UNCTAD advocates for more sustainable and transparent mining contracts and exploration licences to bolster domestic industries and enable local firms in developing countries to better participate in the value chain of renewable energy components.

The organisation emphasises the crucial role of global support in ensuring they have access to the needed investments and technology. The UN, for example, has a key role to play in setting up principles for the fair and sustainable production and trade of the minerals needed for the energy transition.

UNCTAD provides analysis on the trade and development aspects of this sector to the Panel on Critical Energy Transition Minerals, established at the COP28 climate summit by UN Secretary-General António Guterres and launched on 26 April.

“There is now an opportunity to leverage these new commodities to update our trade regime, promote structural diversification and turn the tide of commodity dependence once and for all,” Grynspan says.

Business4 years ago

Business4 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Technology2 years ago

Technology2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Climate Finance2 years ago

Climate Finance2 years ago