THE Rainbow Tourism Group Limited (RTG) has continued on its growth trajectory, delivering a solid performance

in both revenues and profit, as reviewed by the company’s 2018 annual report.

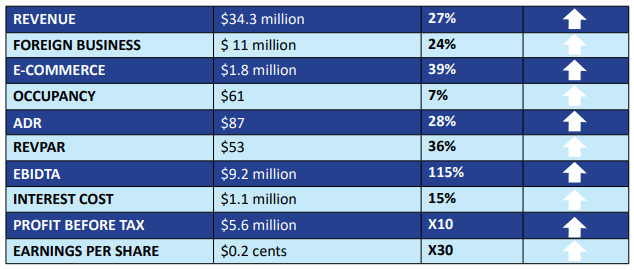

The Rainbow Tourism Group is a hospitality management company which provides hotel conferencing facilities in Zimbabwe and Mozambique. According to the Company Chairman’s report, the RTG produced a pleasing set or results for the year ended 2018 which saw an increase in its revenue by 27 percent ( from 27 million in 2017 to 34.8 million).

The Company’s foreign revenues also grew from 8.9 million recorded in the prior year, to $11 million in 2018 and recorded a growth in the operating profit, which increased 10 times to 5.6 million from $0.55 million. Food and Beverages (F&B) revenue grew by 7 percent mainly driven by the increase in conferencing activities, particularly in city hotels.

ADR grew by 28 percent, driven partly by the need to recover increasing costs, as well as the company’s ability to command better prices from foreign suppliers.

The report reviewed that city hotels accounted for much of the company’s growth in 2018, posting a growth of 34 percent from 20 million in 2017 to $26.8 million in 2018. This is a recovery from the low performance in the past two years, in particular for Rainbow Towers Hotel and Conference Centre.

The Hotel posted a 42 percent growth in revenue to close on $13.6 million from $9.6 million recorded in 2017. City properties also registered a significantly improved performance due to two factors, which includes the business coming from elections and optimism in the economy that drove increased business travel as well as conferencing activities.

Revenue per available room (RevPAR), which is a product of occupancy and rate closed at $53 which is 36 percent above $39 recorded in 2017. EBIRDA for 2018 was $9.2 million, which is 115 percent above full year 2017. The growth in EBITDA is exceptions given the challenges obtaining in the operating environment. Included in the EBIDTA was a recovery of $2.5 million debt from Capital Bank. On a like-for-like basis, the EBITDA for 2018 closed on $6.7 million, a growth of 56 percent above the same period in 2017. The report outlined that the Company is now in a strong position to comply with its borrowing covenants and to complete product refurbishments.

Overall, the company posted a profit before tax of $5.6 million which is 10 times growth from $0.55 million profit recorded in 2017. The resultant profit after tax for the year was $5 million, up from $112.000 recorded in 2017.

2019 Performance Outlook

The RTG recently created two four operations arms, specializing in inbound and outbound travel. The Exotic Travel International (ETI), is RTG’s new subsidiary based in New York City and helps sell destinations across the world to Americans. The local arm, called the Heritage Expeditions Africa, is selling packages for destinations around the country and the region.

The two businesses represent new revenue streams that tap into latent demand for transporting and providing activities to a growing tourism customer base. The Company has also invested in a mobile and web application known as The Gateway Stream. This presents an opportunity for the Company to leverage its revenue generation using information and communication technologies (ICTs) platforms and infrastructure

Business4 years ago

Business4 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Technology2 years ago

Technology2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Climate Finance2 years ago

Climate Finance2 years ago