Business

Zambia to restructure US$1,5bln Glencore debt

-

Business4 years ago

Business4 years ago7 Small Business Tips for effective business

-

Business2 years ago

Business2 years agoBillionaires Who Didn’t Go to College

-

Business2 years ago

Business2 years agoWhat is Robert Kiyosaki’s net worth after his latest book flop?

-

Business2 years ago

Business2 years agoZimbabwe’s Beverage Industry: A Digital Marketing Analysis of Delta Beverages and Varun Beverages Zimbabwe

-

Technology2 years ago

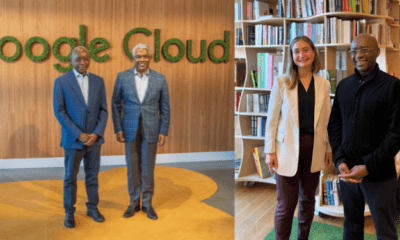

Technology2 years agoLiquid C2 partners with Google Cloud and Anthropic to bring advanced cloud, cyber security and generative AI capabilities to Africa

-

Business2 years ago

Business2 years agoAfrica’s First Black Billionaire Patrice Motsepe Faces a $100 Million Setback

-

Business2 years ago

Business2 years agoEgypt’s Richest Man Nassef Sawiris Sees a $220 Million Dip in Wealth in 2024

-

Climate Finance2 years ago

Climate Finance2 years agoInnovation Zero 2024 Accelerating the Low Carbon Transformation