THE African Development Bank (AfDB) and the NMB Bank Limited Zimbabwe (NMB) yesterday signed a US$15 million facility to boost trade finance.

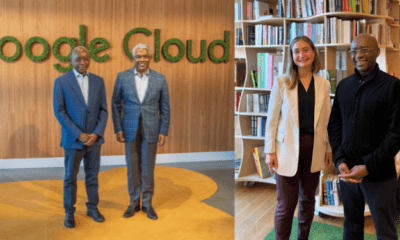

Delegates from both institutions graced the signing ceremony at the NMB Bank headquarters in Harare yesterday. Among them were AfDB country manager Moono Mupotola and NMB Bank chief executive officer, Gerald Gore.

Mupotola expressed enthusiasm about the innovative partnership, stating: “This is a significant step forward in supporting the growth and competitiveness of Zimbabwean businesses.

“By mitigating risk and facilitating access to trade finance, we are empowering SMEs (small and medium enterprises) and local corporates to participate more actively in regional and international trade.”

Gore emphasised the agreement’s importance to Zimbabwe’s economic development. He stated: “This facility will be instrumental in enabling NMB to provide crucial trade finance support to a wider range of Zimbabwean businesses. This will not only unlock new trade opportunities but will also contribute to job creation and economic growth.”

The transaction guarantee, according to a statement released yesterday, is an uncommitted trade finance facility granting NMB Bank access to a maximum of US$15 million, with a tenure of up to 36 months.

“This strategic collaboration aims to unlock significant trade finance opportunities for Zimbabwean businesses, particularly benefiting SMEs and local corporates engaged in agri-business and trade distribution value chains,” the statement read.

This agreement aligns perfectly with AfDB’s broader trade finance programme objectives, with a specific focus on supporting the vital role of SMEs in Africa’s economic development.

It offers up to 100% coverage to confirming banks, effectively mitigating non-payment risks linked to NMB Bank’s trade transactions on a per-transaction basis. Tailored to support intra-Africa trade and trade between Africa and the rest of the world, this facility serves as a versatile and responsive financial solution.

The facility significantly diminishes the risk for international financial institutions, encouraging them to actively engage in trade finance activities with Zimbabwean businesses.

It accommodates various trade instruments, including confirmed letters of credit, trade loans to African banks, irrevocable reimbursement undertakings, availed bills and promissory notes.

By reducing the necessity for cash collateral and offering up to 100% payment guarantee on the transaction value, the arrangement presents an alternative risk management strategy, ensuring the security of trade transactions, especially for the SMEs.

The SMEs often face challenges in accessing trade finance compared to their larger counterparts. This initiative directly addresses this gap, fostering a more vibrant and inclusive business environment in Zimbabwe.

NMB Bank is a multi-award-winning registered commercial bank and the principal subsidiary of NMBZ, a Zimbabwe-based investment holding company listed on the Zimbabwe Stock Exchange. The bank has among its top shareholders strong international and regional entities such as African Century, Arise, Old Mutual and AfricInvest which have a very strong African footprint.

NMB Bank is a registered member of the Deposit Protection Scheme.

Business4 years ago

Business4 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Climate Finance2 years ago

Climate Finance2 years ago

Business2 years ago

Business2 years ago

Technology2 years ago

Technology2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago