VISION Consortium (Vision)’s representatives are due for “crucial talks” in Zimbabwe this week, as the trans-Limpopo group seeks to tie up loose ends in its bid to acquire Tongaat Hullet (Tongaat).

While Finance minister Mthuli Ncube, Remoggo Investments (Remoggo) owner Rutenhuro Moyo and Mutapa Investment Fund (MIF) chair Chipo Mtasa would not readily comment on views that the Zimbabwean sovereign wealth fund SWF) was due to stake a claim in the deal, sources have told The Financial Gazette that the “investors were due for key stakeholder engagements, including regulators on Thursday and Friday”.

And at the back of Mtasa’s disclosures that they “were still working on several issues”, the government insiders have, however, insisted that the “Harare administration was expected to make a comprehensive statement on the transaction soon”.

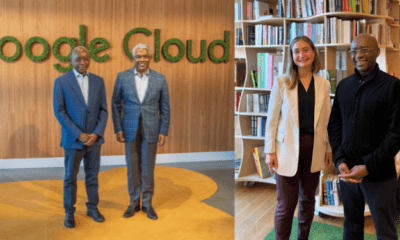

Finance ministry secretary George Guvamatanga

As it is, the success of Moyo and his Vision alliance – comprising South African billionaire Robert Gumede’s – bid was not only attributable to their US$250 million offer to Tongaat’s lender group, but comes in the context of MIF’s known interest as well.

About mid-last year, it emerged that Mtasa’s newly-created behemoth, which falls under the Finance ministry, had dangled a US$95 million carrot for the company’s local assets.

“SWF is interested in acquiring 100 percent of… Triangle Limited and 50,3 percent of… Hippo Valley Estates (Hippo Valley)… held by Tongaat Hulett,” Treasury secretary George Guvamatanga said in a February 2023 letter.

“When the fund made its offer… it was drawing on… the fact of aged plant, equipment and… the need for new, higher-yielding (sugarcane) varieties,” he said.

Nonetheless, Vision’s selection as the preferred bidder has not only added intrigue to the long-drawn acquisition process following the wealthy Rudland family’s failure to buy the firm, but Moyo – an OK Zimbabwe, and National Trye Service major shareholder’s – emergence as a co-bidder has added an interesting twist.

The twists and turns also included Vision’s successes in fending off, if not outwitting, other suitors, including Tanzania’s Kagera and RGS Group Holdings of Mozambique.

With the consortium set to acquire 97,3 percent of the regional company – with assets in Zimbabwe, Botswana, Mozambique and South Africa (SA) – many are envious of Moyo’s grouping “for picking up an asset that can easily pay off its Rand 8 billion debt mountain within the next 10 years by flogging non-core assets and having to access to vast tracts of land across southern Africa.”

In Zimbabwe, for instance, Tongaat has a potential to produce nearly 700 000 tonnes of raw sugar, 80 million litres of ethanol – for the alcohol and chemical industries – has always been a ‘net exporter of power’ from its Lowveld operations, owns a large herd of cattle estimated at 20 000-plus and access to nearly 45 000 hectares of land.

And it is the capability to co-underwrite such a massive transaction, which some say is being backed by ABSA and Investec of SA, that has brought Moyo under sharper focus and his shrewd dealmaking in general. At some point, he even made a bid for Schweppes Zimbabwe.

A solid and proven businessman, the 58-year-old serial entrepreneur was recently thrown into the limelight after his US$420 000 investment into fintech start-up Jamboo, which aims to tap into Africa’s burgeoning diaspora remittances market.

Remoggo Investments (Remoggo) owner Rutenhuro Moyo

On the other hand, Moyo has a rich resume, which includes successful stints at global companies such as Anglo American, Old Mutual, The Coca-Cola Company and Cyril Ramaphosa’s Shanduka Group.

And it is at the latter that he created, and headed the South African president’s fast-moving consumer group’s unit, which manufactured and distributed Coca-Cola products and owned the McDonalds franchise there.

Moyo, who sits on the Hippo and FBC Holdings boards, also owns FedEx through Supa Swift and the Tsebo Catering franchise in the country, which serves as the exclusive food supplier to Zimbabwe Platinum’s Ngezi mines, and Royal Golf Club, among other key establishments.

And with his acquisition of a Tongaat stake through his Mauritian-registered outfit, the reclusive tycoon is also likely to emerge as one of the “single largest customers, and beneficiaries of two of the country’s biggest dams” – Tugwi Mukosi and Osborne in Manicaland – as well as cementing his place as a major investor in a sector that is Zimbabwe’s second largest employer after government.

Against the background of Tongaat’s battles with South African unions over profit share and contract farming – a set of issues almost similar to what Guvamatanga raised in one of his July letters – and Moyo’s own “sparring” with the Harare administration over his retail operations, it remains to be seen how Moyo’s “foreseen cooperation” with the same authorities, and specifically MIF, will pan out.

As the company is reportedly targeting for 50 000 hectares of land – probably to make up for the portion taken by Billy Rautenbach’s Nuanetsi game project – these are not only some of the issues that the Treasury secretary was alluding to by referring to “water, and land rights”, but what the Remoggo chair has to navigate in his quest for the insolvent sugar producer!

Source: Fingaz

Business4 years ago

Business4 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Climate Finance2 years ago

Climate Finance2 years ago

Business2 years ago

Business2 years ago

Technology2 years ago

Technology2 years ago

Business2 years ago

Business2 years ago

Business2 years ago

Business2 years ago